US environmental NGO Rainforest Action Network (RAN), along with other NGOs, released a new report last new titled “Fossil Fuel Finance Report 2023: Bankrolling Climate Chaos” (14th edition). This comprehensive analysis on banking for fossil fuels examines banks’ climate commitments by scrutinizing their funding for the fossil fuel industry, including Japanese banks.

For the first time since 2019, a Canadian bank surpassed JPMorgan Chase as the top annual funder of fossil fuels. Royal Bank of Canada (RBC) invested $42.1 billion in fossil fuel projects in 2022, including $4.8 billion in tar sands and $7.4 billion in shale gas sectors. Canadian banks have become the last resort for fossil fuels, providing $862 billion to fossil fuel companies since the Paris Agreement. RBC continues to fund expansion projects like the Coastal GasLink pipeline for shale gas, violating human rights and indigenous sovereignty without consent from indigenous leaders.

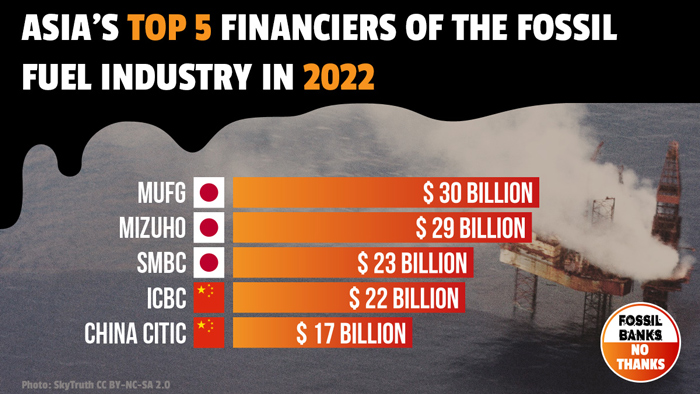

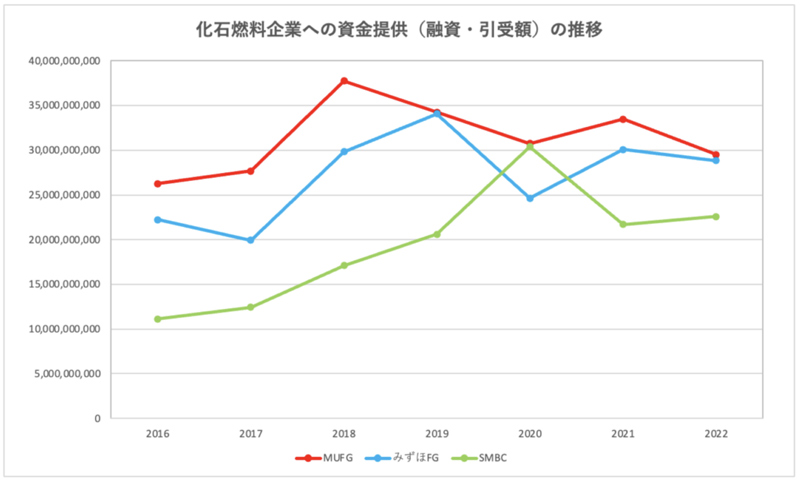

The report shows that US banks dominate overall fossil fuel funding, accounting for 28% of total lending in 2022. Citi, Wells Fargo, and Bank of America remain in the top five funders since 2016. Meanwhile, Mitsubishi UFJ Financial Group (MUFG), Mizuho Financial Group (Mizuho FG), and Sumitomo Mitsui Financial Group (SMBC Group) ranked in the worst 10 for overall fossil fuel funding in 2022.

Europeans and Ukrainians called for a transition to renewable energy to stop funding Russia’s atrocities, but fossil fuel companies doubled their expansion efforts, undermining climate action. The top 30 companies expanding liquefied natural gas (LNG) secured nearly 50% more funds from banks in 2022 compared to 2021, exploiting the crisis. However, most energy experts agree that LNG expansion plans in Europe are unnecessary and new projects will contribute to fossil fuel oversupply and long-term dependence.

According to the report, banks’ net-zero pledges have no merit so far. Of the 60 banks examined, 49 have made net-zero commitments, but most lack strict policies to exclude lending for fossil fuel expansion. Actual policies contain many loopholes, allowing banks to continue lending to fossil fuel clients.

As confirmed by the Intergovernmental Panel on Climate Change (IPCC) in its March 2023 report, to give humanity a chance to avoid unacceptable damage affecting millions of people today and countless future generations, we must halt fossil fuel expansion and rapidly decrease its use across all sectors. The IPCC argues that the window to maintain temperatures below 1.5 degrees and create a safe, livable, and sustainable future is rapidly closing.

What are some trends in the fossil fuel industry observed in the report?

- Expanding companies: The 60 banks covered in this report invested $150 billion in the top 100 fossil fuel-expanding companies in 2022, including TC Energy, Total Energies, Venture Global, ConocoPhillips, and Saudi Aramco.

- Liquefied Natural Gas (LNG): The leading banks in providing funding for LNG in 2022 were Mizuho FG, Morgan Stanley, JPMorgan Chase, ING, Citi, and SMBC Group. Overall funding for LNG increased by nearly 50% from $15.2 billion in 2021 to $22.7 billion in 2022.

- Oil Sands (Tar Sands): In 2022, the top oil sands companies received $21 billion in funding, with 89% of this funding provided by major Canadian banks. TD, RBC, and Bank of Montreal were at the top.

- Arctic Oil and Gas: Chinese banks, including ICBC, Agricultural Bank of China, and China Construction Bank, led the funding for Arctic oil and gas projects, investing a total of $2.9 billion in this sector’s top companies in 2022. Twenty-six banks, including U.S. banks, still provide funding for Arctic oil and gas, such as JPMorgan Chase, Citi, and Bank of America.

- Amazon Oil and Gas: Spain’s Santander Bank leads the funding for companies extracting resources from the Amazon ecosystem, closely followed by U.S. bank Citi. The total amount of funding in 2022 was $760.9 million.

- Shale Oil and Gas: Financing for fracking companies reached a total of $67 billion in 2022, an 8% increase from the funding reported for the top fracking companies in 2021. Considering the extreme methane emissions from fracking, this increase is particularly concerning. RBC and JPMorgan Chase are the largest funders of oil and gas fracking since the Paris Agreement took effect and in 2022.

- Offshore Oil and Gas: European banks BNP Paribas, Credit Agricole, and Japanese bank SMBC Group were at the top of the worst funding list for offshore oil and gas in 2022. The total amount of funding in 2022 was $34 billion.

- Coal Mining: Of the $13 billion provided to the world’s 30 largest coal mining companies, 87% came from Chinese banks, led by China CITIC Bank, China Everbright Bank, and Industrial Bank.

- Coal-fired Power Generation: Of the financing for the world’s top 30 coal-fired power generation companies, 97% came from Chinese banks. These companies, which plan to expand coal-fired power generation capacity, received $29.5 billion from profiled banks in 2022.

In addition to the overall funding for fossil fuel companies in 2022, MUFG, Mizuho FG, and SMBC Group were among the worst 10 in terms of funding for LNG and Arctic oil and gas sectors, as well as for fossil fuel-expanding companies in 2022. Specifically, in the 2022 funding for the top 30 LNG companies, Mizuho FG became the first to rank first, replacing Morgan Stanley, and from 2016 to 2022, all three mega-banks were among the worst 10 in terms of cumulative funding in the LNG sector. In terms of overall funding for fossil fuel companies, MUFG ranked 6th, Mizuho FG 8th, and SMBC Group 16th.

Environmental NGOs emphasize that Japan’s three mega banks continue to provide significant support to fossil fuel projects, despite declaring net-zero emissions targets by 2050 and acknowledging the urgent need for renewable energy and decarbonization. They criticize the banks for lacking policies to limit funding for new fossil fuel developments, which contradicts international agreements and exacerbates the climate crisis.

More articles about energy in Japan

- 2025-10-12: Four firms unite to cut AI data centre energy use across Japan

- 2025-02-20: U.S.-Japan LNG agreement sparks environmental concerns

- 2024-10-28: University of Colorado students explore renewable energy with Japan tour

- 2024-10-23: U.S. climate activists urge Japan to end financing harming LNG projects

- 2023-06-29: Japan's Renewable Energy Progress: Analysis from 2022 ISEP Report